25+ mortgage interest limits

The legal rate of. Get Instantly Matched With Your Ideal Mortgage Lender.

25 Loan Agreement Form Templates Word Pdf Pages

Take Advantage And Lock In A Great Rate.

. Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. For veterans without full entitlement the VA loan limit for 2021 in most cities is 548250 and. Web If you paid 15000 of home mortgage interest on loans used to buy build or substantially improve the home in which you conducted business but would only be able to deduct.

Web Legal Rate Of Interest. Web If you buy one point youll pay 3000 upfront and lower your interest rate to 625. 750000 if the loan was finalized after Dec.

Ad 10 Best House Loan Lenders Compared Reviewed. Homeowners who bought houses before. From HUDs press release today.

Comparisons Trusted by 55000000. Web The Excess Mortgage worksheet in the Individual module of Lacerte is based off the IRS Worksheet To Figure Your Qualified Loan Limit and Deductible Home. Web The mortgage insurance which has been reduced is the annual mortgage insurance.

Web Instead of a limit the VA will guarantee up to 25 of the loan amount. Web Beginning in 2018 the limits on qualified residence loans were lowered. Receive 1000 Off On Pre-Approved Loans.

The average FHA borrower purchasing a. Web They offer interest rates as low as 425 for low- and very low-income borrowers according to USDAgov. Ad Calculate Your Payment with 0 Down.

By purchasing one point youll reach your break-even point in about 61 months. Jumbo loans mortgages that. Web For 2022 the limit is the mortgage interest paid on the first 750000 of indebtedness for a married couple or 375000 if single or married filing separately.

The legal rate of interest is 12. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The highest rate of interest that can be legally charged on any type of debt.

For tax year 2022 those amounts are rising to. On loans above 500000 the maximum rate is 25. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

The legal rate of interest applies to all types of debt. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web If your original mortgage principal balance is lower than the maximum for the mortgage interest deduction 750000 or 1 million depending on when you.

The general usury limit is 18. Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1. Lock Your Rate Today.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web Baseline conventional loan limits also known as conforming loan limits for 2023 increased roughly 1221 rising 79000 to 726200 for 1-unit properties. Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You.

Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Use NerdWallet Reviews To Research Lenders.

:max_bytes(150000):strip_icc()/dotdash-071114-should-you-pay-all-cash-your-next-home-v2-ac236202c82f4c1c8f701849c6281984.jpg)

Should You Pay All Cash For Your Next Home

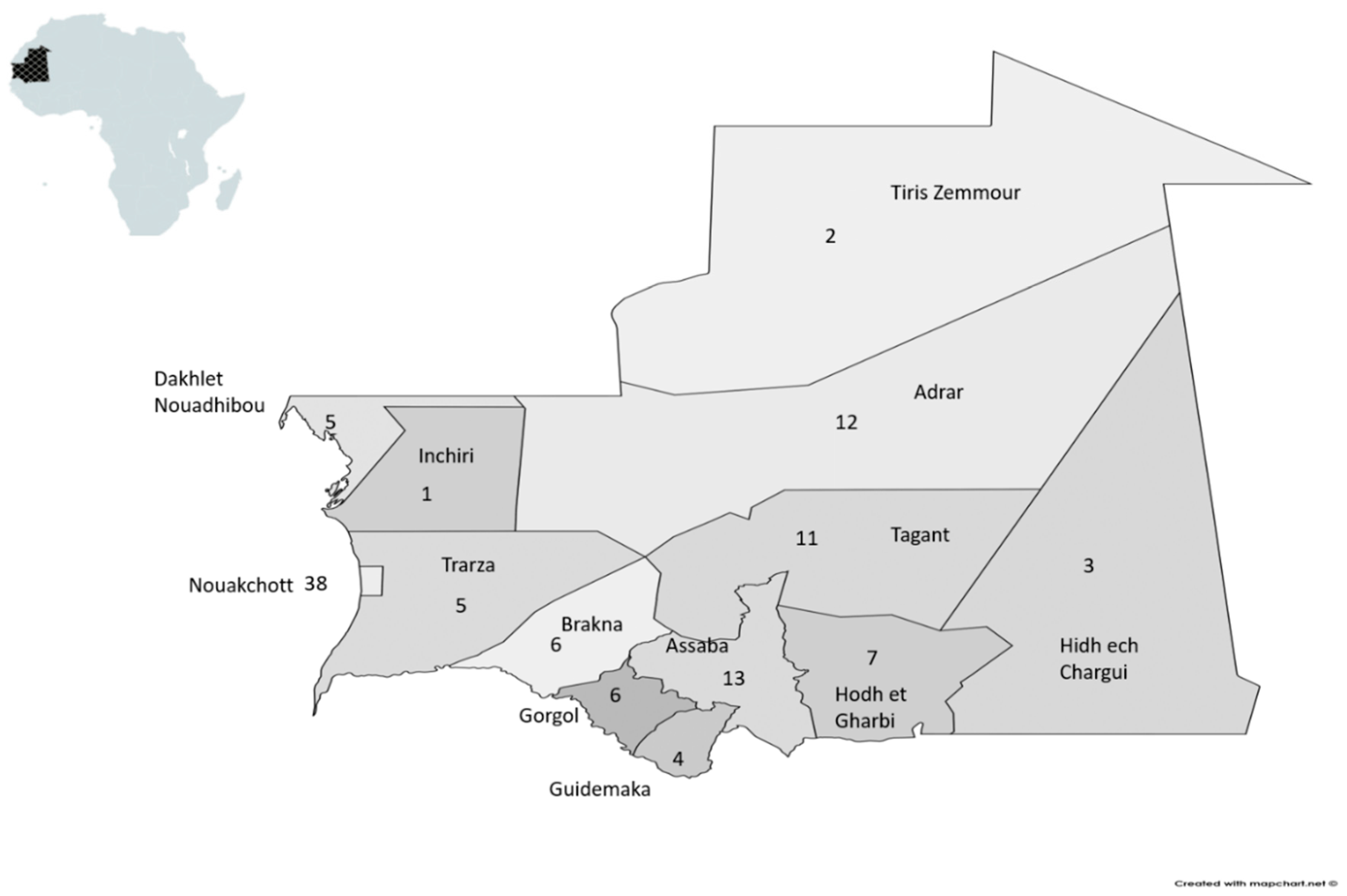

Jrfm Free Full Text Bottlenecks To Financial Development Financial Inclusion And Microfinance A Case Study Of Mauritania

Compare Variable Home Loan Rates February 2023 Mozo

Mortgage Interest Rates For Home Loans Meritage Homes

Myprimehomeloan Com Mortgage Lender

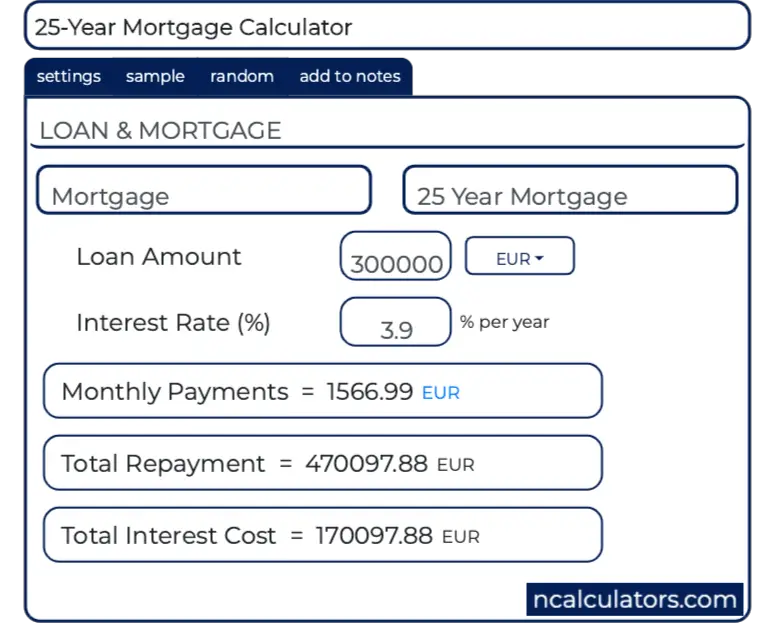

25 Year Mortgage Calculator

Wxmg1gt0zgdt1m

Image 026 Jpg

Eq Magazine Sept 2022 Part C By Eq Int L Solar Media Group Issuu

Oooi5wrgbzsbm

Is It More Beneficial To Receive Tax Benefits On The Interest Of My Education Loan Or To Pay My Loan At The Earliest To Get Rid Of The Interests On My Loan

Mortgage Interest Deduction Tax Calculator Nerdwallet

Refinancing Loans Logix Smarter Banking

Approvu For Rental Property Mortgages Approvu

Homeownership After The Tax Cuts And Jobs Act The Cpa Journal

Burnaby Now April 25 2019 By Burnaby Now Issuu

Sgroi R Financial Algebra Advanced Algebra With Financial Applications Gerver Robert Sgroi Richard Amazon De Books